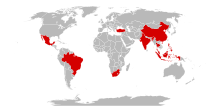

V? tri cac n?n kinh t? đang n?i len tren b?n đ? th? gi?i, theo

Morgan Stanley Capital International

2006

V? tri cac n?n kinh t? đang n?i len tren b?n đ? th? gi?i, theo

Morgan Stanley Capital International

2006

Cac n?n kinh t? đang n?i len

Cac n?n kinh t? phat tri?n

Cac n?n kinh t? đang n?i len

la nh?ng n?n kinh t? đang trong giai đo?n qua đ? t?

n?n kinh t? đang phat tri?n

thanh

n?n kinh t? phat tri?n

.

[1]

Tuy nhien, khong co tieu chi ro rang va ph? bi?n nao đ? xac đ?nh m?t n?n kinh t? co ph?i la n?n kinh t? đang n?i len hay khong.

[2]

IMF

th??ng x?p chung cac n?n kinh t? đang n?i len va cac n?n kinh t? đang phat tri?n vao cung m?t nhom trong cac tai li?u v? kinh t? th? gi?i c?a minh ma khong chia thanh hai nhom rieng.

The Economist

co tieu chi xac đ?nh rieng d?a vao thong tin v?

đ?u t?

.

[3]

Morgan Stanley Capital International

c?ng co cach xac đ?nh rieng, va nh?ng n?n kinh t? sau đ??c t? ch?c nay coi la cac n?n kinh t? đang n?i len:

- M? Latinh

g?m:

Argentina

,

Brasil

,

Chile

,

Colombia

,

Mexico

va

Peru

- Chau A

g?m:

?n đ?

,

đai Loan

,

Han Qu?c

,

Indonesia

,

Jordan

,

Malaysia

,

Pakistan

,

Vi?t Nam

,

Philippines

va

Thai Lan

- Chau Phi

g?m:

Ai C?p

,

Maroc

va

Nam Phi

- Chau Au

g?m:

Ba Lan

,

Israel

,

Hungary

,

Nga

,

Sec

va

Th? Nh? K?

.

Danh sach cac n?n kinh t? đang n?i len c?a The Economist t??ng t? nh? tren, nh?ng co them

Singapore

,

Hong Kong

va

? R?p Xe Ut

, khong co

Jordan

.

Trong tai li?u c?a IMF thi đai Loan, Hong Kong, Singapore, Han Qu?c l?i đ??c x?p vao nh?ng n?n kinh t? phat tri?n.

Vi?n Kinh t? Qu?c t?

c?a M? co l?p danh sach nh?ng n?n kinh t? đang n?i len l?n (LEMs) bao g?m 4 n??c

BRIC

c?ng v?i

Argentina

,

Indonesia

,

Han Qu?c

,

Mexico

,

? R?p Xe Ut

, va

Th? Nh? K?

.

Trong th?p nien1970, "cac n??c kem phat tri?n" (LDCs) la thu?t ng? chung đ? ch? cac th? tr??ng kem "phat tri?n" (b?ng cac bi?n phap khach quan ho?c ch? quan) so v?i cac n??c phat tri?n nh? Hoa K?, Nh?t B?n va cac n??c Tay Au. Nh?ng th? tr??ng nay đ??c cho la mang l?i ti?m n?ng l?i nhu?n l?n h?n nh?ng c?ng co nhi?u r?i ro h?n t? cac y?u t? khac nhau nh?

vi ph?m b?ng sang ch?

. Thu?t ng? nay đa đ??c thay th? b?ng

th? tr??ng m?i n?i

. Thu?t ng? nay gay hi?u l?m ? ch? khong co gi đ?m b?o r?ng m?t qu?c gia s? chuy?n t? "kem phat tri?n" sang "phat tri?n h?n"; m?c du đo la xu h??ng chung tren th? gi?i, cac n??c c?ng co th? chuy?n t? “phat tri?n h?n” sang “kem phat tri?n h?n”.

Nha kinh t? Antoine Van Agtmael c?a

Ngan hang Th? gi?i

đa đ?t ra thu?t ng? nay vao n?m 1981,

[4]

thu?t ng? nay đoi khi đ??c s? d?ng m?t cach s? sai đ? thay th? cho

cac n?n kinh t? m?i n?i

, nh?ng th?c s? bi?u th? m?t hi?n t??ng kinh doanh khong đ??c mo t? đ?y đ? ho?c b? h?n ch? b?i đi?u đo; nh?ng qu?c gia nay đ??c coi la đang trong giai đo?n chuy?n ti?p gi?a tr?ng thai

đang phat tri?n

va

đa phat tri?n

. Vi d? v? cac th? tr??ng m?i n?i bao g?m nhi?u n??c ? Chau Phi, h?u h?t cac n??c ? đong Au, m?t s? n??c ? Chau M? Latinh, m?t s? n??c ? Trung đong, Nga va m?t s? n??c ? đong Nam A. Nh?n m?nh tinh ch?t linh ho?t c?a danh m?c nay, nha khoa h?c chinh tr?

Ian Bremmer

đ?nh ngh?a th? tr??ng m?i n?i la "m?t qu?c gia n?i chinh tr? it quan tr?ng nh? kinh t? đ?i v?i th? tr??ng".

Cac qu?c gia cong nghi?p hoa m?i,

tinh đ?n

n?m 2013. đay la danh m?c trung gian gi?a phat tri?n hoan ch?nh va đang phat tri?n

Cac qu?c gia cong nghi?p hoa m?i,

tinh đ?n

n?m 2013. đay la danh m?c trung gian gi?a phat tri?n hoan ch?nh va đang phat tri?n

Nghien c?u v? cac th? tr??ng m?i n?i r?t ph? bi?n trong cac tai li?u

qu?n ly

. Trong khi cac nha nghien c?u nh?

George Haley

,

Vladimir Kvint

,

Hernando de Soto

,

Usha Haley

, va m?t s? giao s? t?

Tr??ng Kinh doanh Harvard

va

Tr??ng Qu?n ly Yale

đa mo t? ho?t đ?ng ? cac qu?c gia nh? ?n đ? va Trung Qu?c thi vi?c th? tr??ng n?i len nh? th? nao v?n co it ng??i hi?u.

Vao n?m 2009, Ti?n s? Kvint đa cong b? đ?nh ngh?a nay: "m?t qu?c gia th? tr??ng m?i n?i la m?t xa h?i chuy?n đ?i t? ch? đ? đ?c tai sang n?n kinh t? đ?nh h??ng th? tr??ng t? do, v?i s? gia t?ng t? do kinh t?, h?i nh?p d?n d?n v?i Th? tr??ng toan c?u va v?i cac thanh vien khac c?a GEM (Th? tr??ng m?i n?i toan c?u), t?ng l?p trung l?u ngay cang m? r?ng, nang cao m?c s?ng, ?n đ?nh xa h?i va s? khoan dung, c?ng nh? t?ng c??ng h?p tac v?i cac t? ch?c đa ph??ng".

[5]

Nhi?u ngu?n khac nhau li?t ke cac qu?c gia la "cac n?n kinh t? m?i n?i" nh? đ??c ch? ra trong b?ng d??i đay.

M?t vai qu?c gia xu?t hi?n trong m?i danh sach (BRICS, Mexico, Th? Nh? K?). Indonesia va Th? Nh? K? đ??c phan lo?i cung v?i Mexico va Nigeria la m?t ph?n c?a n?n kinh t?

MINT

. M?c du khong co cac tham s? đ??c th?ng nh?t chung ma cac qu?c gia co th? đ??c phan lo?i la "Cac n?n kinh t? m?i n?i", m?t s? cong ty đa phat tri?n cac ph??ng phap lu?n chi ti?t đ? xac đ?nh cac n?n kinh t? m?i n?i ho?t đ?ng t?t nh?t hang n?m.

[6]

Vao thang 11 n?m 2010, Nghien c?u

BBVA

đa đ?a ra m?t khai ni?m kinh t? m?i, đ? xac đ?nh cac th? tr??ng m?i n?i quan tr?ng.

[15]

Phan lo?i nay đ??c chia thanh hai nhom cac n?n kinh t? đang phat tri?n.

K? t? thang 3 n?m 2014, cac nhom nh? sau:

EAGLEs

(cac n?n kinh t? m?i n?i va d?n đ?u t?ng tr??ng): GDP Gia t?ng d? ki?n trong 10 n?m t?i s? l?n h?n m?c trung binh c?a cac n?n kinh t? G7, ngo?i tr? Hoa K?.

NEST

: D? ki?n gia t?ng GDP trong th?p k? t?i s? th?p h?n m?c trung binh c?a cac n?n kinh t? G6 (G7 khong bao g?m M?) nh?ng cao h?n c?a Y.

Th? tr??ng m?i n?i khac

Ch? s? th? tr??ng m?i n?i

[

s?a

|

s?a ma ngu?n

]

Ch? s? cac th? tr??ng m?i n?i c?a MasterCard la danh sach 65 thanh ph? hang đ?u trong cac th? tr??ng m?i n?i. Cac qu?c gia sau co cac thanh ph? đ??c đ?a vao danh sach (tinh đ?n n?m 2008):

Cac qu?c gia co thanh ph? đ??c đ?a vao Ch? s? cac th? tr??ng m?i n?i n?m 2008

[

s?a

|

s?a ma ngu?n

]

B?ng d??i đay li?t ke 25 n?n kinh t? m?i n?i l?n nh?t tinh theo GDP (danh ngh?a) va GDP (PPP) trong n?m cao đi?m t??ng ?ng. Cac thanh vien c?a

G-20 n?n kinh t? l?n

đ??c in đ?m.

| X?p h?ng

|

Qu?c gia

|

GDP

(danh ngh?a, n?m cao đi?m)

hang tri?u

USD

|

Peak Year

|

| 1

|

China

China

|

16,862,979

|

2021

|

| 2

|

India

India

|

3,022,061

|

2019

|

| 3

|

Brazil

Brazil

|

2,614,027

|

2011

|

| 4

|

Russia

Russia

|

2,288,428

|

2013

|

| 5

|

South Korea

South Korea

|

1,823,852

|

2021

|

| 6

|

Mexico

Mexico

|

1,315,356

|

2014

|

| 7

|

Indonesia

Indonesia

|

1,150,245

|

2021

|

| 8

|

Iran

Iran

|

1,081,383

|

2021

|

| 9

|

Turkey

Turkey

|

957,504

|

2013

|

| 10

|

Saudi Arabia

Saudi Arabia

|

842,588

|

2021

|

| 11

|

Taiwan

Taiwan

|

785,589

|

2021

|

| 12

|

Poland

Poland

|

655,332

|

2021

|

| 13

|

Argentina

Argentina

|

643,861

|

2017

|

| 14

|

Nigeria

Nigeria

|

568,499

|

2014

|

| 15

|

Thailand

Thailand

|

546,223

|

2021

|

| 16

|

Israel

Israel

|

467,532

|

2021

|

| 17

|

South Africa

South Africa

|

458,708

|

2011

|

| 18

|

United Arab Emirates

United Arab Emirates

|

422,215

|

2018

|

| 19

|

Egypt

Egypt

|

396,328

|

2021

|

| 20

|

Philippines

Philippines

|

385,737

|

2021

|

| 21

|

Colombia

Colombia

|

382,093

|

2013

|

| 22

|

Singapore

Singapore

|

378,645

|

2021

|

| 23

|

Malaysia

Malaysia

|

371,114

|

2021

|

| 24

|

Hong Kong

Hong Kong

|

369,722

|

2021

|

| 25

|

Vietnam

Vietnam

|

368,002

|

2021

|

| X?p h?ng

|

Qu?c gia

|

GDP

(PPP, Peak Year)

hang tri?u

USD

|

Peak Year

|

| 1

|

China

China

|

27,071,959

|

2021

|

| 2

|

India

India

|

10,181,166

|

2021

|

| 3

|

Russia

Russia

|

4,447,477

|

2021

|

| 4

|

Indonesia

Indonesia

|

3,530,329

|

2021

|

| 5

|

Brazil

Brazil

|

3,437,609

|

2021

|

| 6

|

Turkey

Turkey

|

2,873,841

|

2021

|

| 7

|

Mexico

Mexico

|

2,685,253

|

2021

|

| 8

|

South Korea

South Korea

|

2,503,395

|

2021

|

| 9

|

Saudi Arabia

Saudi Arabia

|

1,734,234

|

2021

|

| 10

|

Taiwan

Taiwan

|

1,443,411

|

2021

|

| 11

|

Poland

Poland

|

1,412,297

|

2021

|

| 12

|

Egypt

Egypt

|

1,381,057

|

2021

|

| 13

|

Iran

Iran

|

1,344,086

|

2011

|

| 14

|

Thailand

Thailand

|

1,339,060

|

2019

|

| 15

|

Pakistan

Pakistan

|

1,157,480

|

2021

|

| 16

|

Vietnam

Vietnam

|

1,141,300

|

2021

|

| 17

|

Nigeria

Nigeria

|

1,136,795

|

2021

|

| 18

|

Argentina

Argentina

|

1,049,401

|

2021

|

| 19

|

Philippines

Philippines

|

1,004,508

|

2019

|

| 20

|

Malaysia

Malaysia

|

969,039

|

2021

|

| 21

|

Bangladesh

Bangladesh

|

953,385

|

2021

|

| 22

|

South Africa

South Africa

|

861,929

|

2021

|

| 23

|

Colombia

Colombia

|

812,799

|

2021

|

| 24

|

United Arab Emirates

United Arab Emirates

|

699,444

|

2021

|

| 25

|

Romania

Romania

|

653,903

|

2021

|

|

|---|

|

|

|---|

| Chau Phi

| |

|---|

| Chau Phi–Chau A

| |

|---|

| Chau M?

| |

|---|

| Chau A

| |

|---|

| Chau Au

| |

|---|

| A Au

| |

|---|

| B?c M?–Chau Au

| |

|---|

Chau Phi–Chau A

–Chau Au

| |

|---|

| Chau Phi–Nam M?

| |

|---|

Chau đ?i D??ng

–Thai Binh D??ng

| |

|---|

| Khong theo vung

| |

|---|

| Toan c?u

| |

|---|

|

|